The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

Blog Article

The Main Principles Of Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe 9-Second Trick For Mileagewise - Reconstructing Mileage LogsUnknown Facts About Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs - The FactsSome Known Factual Statements About Mileagewise - Reconstructing Mileage Logs The 4-Minute Rule for Mileagewise - Reconstructing Mileage LogsNot known Factual Statements About Mileagewise - Reconstructing Mileage Logs Not known Factual Statements About Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance function recommends the fastest driving path to your workers' location. This feature enhances efficiency and contributes to cost financial savings, making it an essential possession for services with a mobile workforce.Such a method to reporting and conformity streamlines the frequently intricate job of handling gas mileage expenses. There are several advantages linked with using Timeero to monitor gas mileage. Allow's have a look at a few of the application's most notable features. With a trusted gas mileage monitoring device, like Timeero there is no need to worry concerning unintentionally leaving out a date or piece of details on timesheets when tax time comes.

Getting My Mileagewise - Reconstructing Mileage Logs To Work

These additional verification measures will maintain the IRS from having a reason to object your mileage records. With accurate mileage tracking technology, your staff members do not have to make harsh gas mileage price quotes or also worry regarding gas mileage cost tracking.

As an example, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all car expenditures. You will need to continue tracking gas mileage for work also if you're using the actual cost method. Keeping gas mileage documents is the only means to different company and personal miles and give the proof to the internal revenue service

The majority of gas mileage trackers let you log your journeys manually while determining the range and reimbursement amounts for you. Many likewise come with real-time trip tracking - you require to start the app at the start of your journey and stop it when you reach your last destination. These apps log your begin and end addresses, and time stamps, together with the total range and repayment quantity.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

Among the concerns that The INTERNAL REVENUE SERVICE states that lorry expenses can be taken into consideration as an "common and required" price throughout working. This includes costs such as gas, maintenance, insurance policy, and the car's devaluation. For these costs to be taken into consideration deductible, the lorry ought to be utilized for service purposes.

The 5-Second Trick For Mileagewise - Reconstructing Mileage Logs

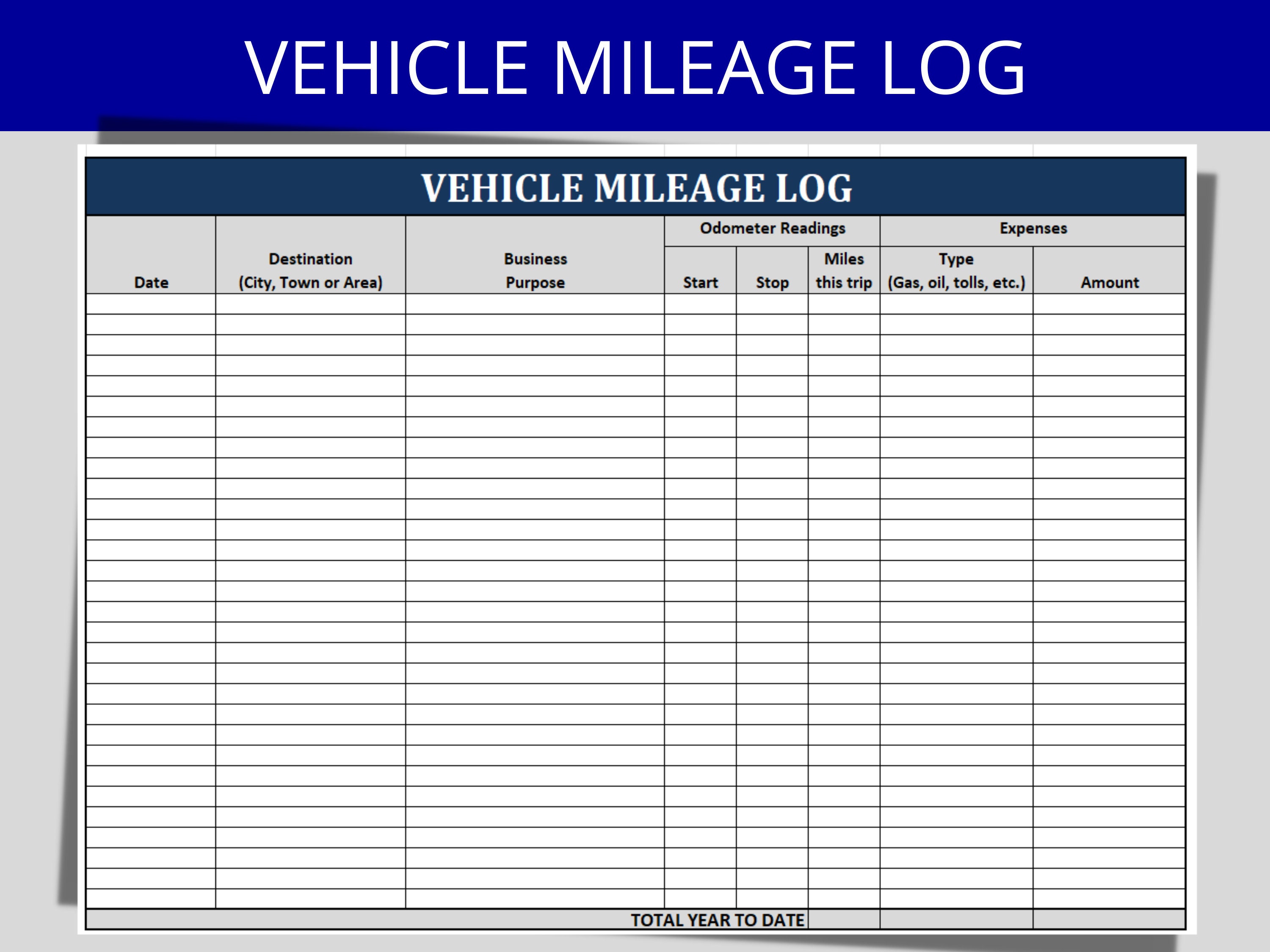

In between, diligently track all your service journeys noting down the beginning and finishing readings. For each trip, record the area and service purpose.

This consists of the total business mileage and total mileage build-up for the year (business + personal), journey's day, destination, and objective. It's crucial to videotape tasks quickly and preserve a synchronic driving log detailing date, miles driven, and business purpose. Below's how you can improve record-keeping for audit functions: Start with making certain a careful mileage log for all business-related traveling.

Some Ideas on Mileagewise - Reconstructing Mileage Logs You Need To Know

The real costs method is an alternate to the conventional mileage rate technique. Instead of computing your deduction based on an established rate per mile, the real expenditures approach allows you to deduct the real prices related to using your lorry for service purposes - best free mileage tracker app. These expenses include fuel, upkeep, repairs, insurance coverage, devaluation, and other associated expenses

Those with significant vehicle-related expenses or special conditions might benefit from the actual expenditures technique. Eventually, your picked method needs to straighten with your details economic objectives and tax obligation scenario.

Not known Details About Mileagewise - Reconstructing Mileage Logs

(https://www.goodreads.com/user/show/183824095-tess-fagan)Determine your total business miles by utilizing your begin and end odometer readings, and your tape-recorded organization miles. Accurately tracking your precise mileage for company trips aids in substantiating your tax obligation deduction, specifically if you opt for the Criterion Mileage technique.

Maintaining track of your gas mileage by hand can require diligence, yet keep in mind, it can save you money on your tax obligations. Tape-record the total mileage driven.

The Main Principles Of Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline company sector came to be the first commercial users of GPS. By the 2000s, the shipping sector had actually embraced general practitioners to track bundles. And currently almost everybody uses GPS Your Domain Name to get around. That indicates virtually everyone can be tracked as they deal with their service. And there's the rub.

Report this page